About Arizona School Choice Trust

Arizona School Choice Trust is a state-approved School Tuition Organization certified to receive tax credit contributions. For 30 years we have been serving students in Arizona.

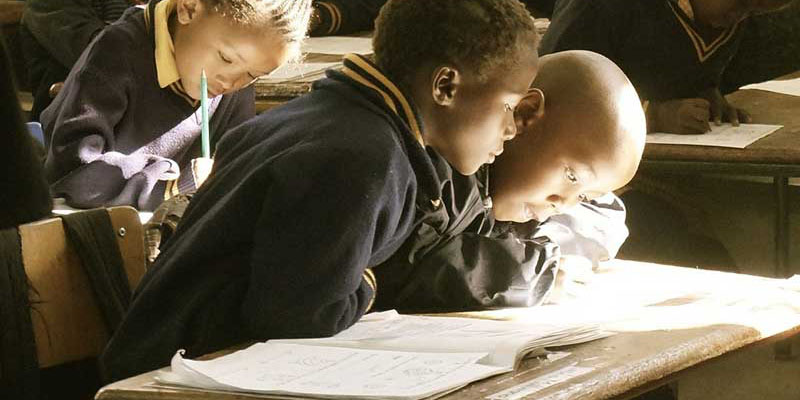

The mission of ASCT is to provide hope and opportunity for low-income children, foster children, and children with disabilities through private school scholarships. Support our work – DONATE HERE.

Read More

PARENTS AND STUDENTS

Applications opened January 19th for the 2022-2023 school year, except for special circumstances. Arizona School Choice Trust participates in all four tax credit programs: Corporate, Individual (Original), PLUS (Overflow), and Disabled/Displaced (Lexie’s Law)

DONORS

YOU can help Arizona School Choice Trust provide scholarships to deserving children AND receive a dollar-for-dollar tax credit for contributions! Your donation will make an immediate difference in the life of a child. Donate here.